HGB Prime Charge on Debit Card: Is this Charge legit or a scam?

Have you ever spotted an HGB Prime Charge on debit card statement? If yes, don’t worry—this comprehensive guide will clear up all your doubts. Because many people are curious about what this charge means, where it comes from, and whether it’s legitimate or not.

HGB Prime Charge on debit card refers to charges related to subscriptions or one-time payments made to the company through your debit card.

In this in-depth guide, we will break down everything about the charge, including what it is, why it appears, and what steps you can take if you spot it along with user experience and real stories of how people resolved heir HGB Prime Charge issues. Let’s dive in!

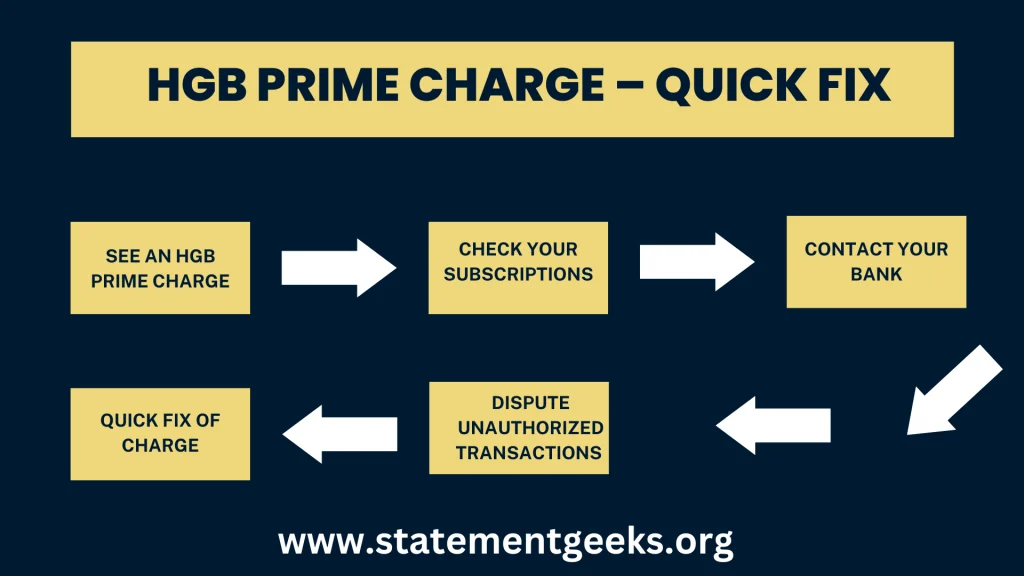

HGB Prime Charge on Debit Card– Quick Fix

“If you see an HGB Prime charge on debit card, check your subscriptions, contact your bank, and dispute unauthorized transactions immediately. Here’s how…”

Read Also HGB Prime Charge on Your Bank Statement: A Guide for Military Health Insurance Transactions

What is HGB Prime Charge on Debit Card?

It is a transaction that appeared on your debit card statement due to subscriptions that you have made online. Transactions include media subscriptions, online memberships, premium quality content, any online digital services, online purchases, etc.

Simply, any premium subscriptions that you have signed up for online. HGB Prime is likely a descriptor used by a third-party payment processor or merchant. You can easily identify the HGB PRIME on your debit card statement.

Why Does the HGB Prime Debit Card Charge Appear on Your Statement?

The reason for the appearance of this charge is common services that are associated with HGB Prime which are listed below:

Subscription Services

A common reason is the subscription of different services such as streaming services, software licenses, and memberships of sites. Because many online platforms use third-party payment processors to handle the transactions. When you sign up for any type of service, the charge might appear as “HGB Prime.”

Recurring Payments

If you authorized a recurring payment for a service or product, the merchant might use HGB Prime as the billing descriptor.

Online Purchases

Some e-commerce platforms or digital marketplaces use HGB Prime as their payment gateway, which could explain the charge.

Note: These subscriptions are monthly or annual basis. Some are on a trial basis when the trial period is finished the services might be started to bill you.

Read More VIOC Charge on Bank Statement! A Clear Explanation

User Experience: Dealing with an Unexpected HGB Prime Charge on debit card

My close friend David Smith noticed a $9.99 charge from HGB Prime on his debit card. He was confused about it, but the steps he took to identify the source were that he checked his email and found an old subscription he had forgotten about.

What action did he take? He took the measure that he logged into the service, canceled the subscription, and avoided future charges.

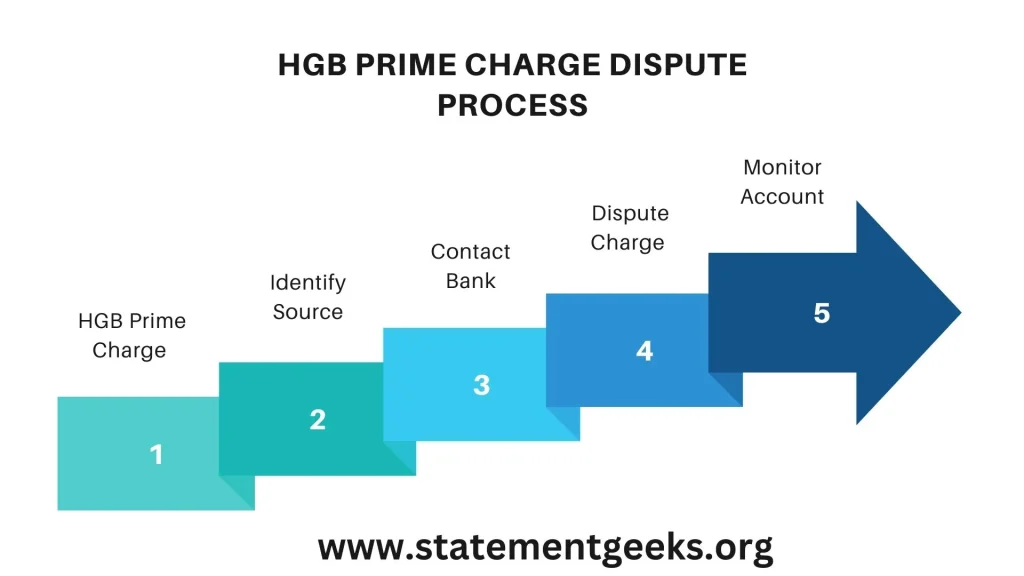

How to Identify the Source of the HGB Prime Charge?

To identify the source of the charge in case of ambiguity, follow the below easy steps:

Review Your Recent Purchases

The first step is to review your purchases and verify them from email, confirmation messages, and receipts. Most important you can also check your browser history to see if you visited any websites that might have triggered the charges.

Contact Your Bank

Reach out to your bank or card issuer for more details about the transaction. They may be able to provide additional information about the merchant.

Search Online

Use search engines to look up “HGB Prime charge” along with the amount and date of the transaction. Others may have shared similar experiences that can help you identify the source.

Check Your Subscriptions

Review your active subscriptions and memberships to see if any of them use HGB Prime as their payment processor.

Real Stories: How People Resolved Their HGB Prime Charge Issues

My friend Sarah Hunter once saw an unauthorized $14.99 HGB Prime charge on her bank statement. She immediately called her bank, reported the issue, and got the charge reversed within three days. To prevent this from happening again, she enabled transaction alerts on her banking app.

What to Do If You Don’t Recognize the HGB Prime Charge?

After adopting the above-stated easy steps, if you are still confused about recalling the charge’s legitimacy then follow the below steps:

Dispute the Charge

Contact your bank or card issuer immediately to dispute the charge. Every bank has a fraud protection department to investigate the dispute. Understanding your rights to dispute is very crucial at this moment because the U.S. Department of Justice (Office of Justice programs) provides the Fair Credit Reporting Act to protect our consumers.

Cancel Your Card

If you suspect fraud, request a new debit card to prevent further unauthorized charges.

Monitor Your Account

Keep a close eye on your bank statements for any additional suspicious activity.

Report Fraud

File a report with your bank and, if necessary, local authorities to document the incident.

Read More Understanding FDMS Charge on Bank Statement!

Charge Dispute Template: How to Request a Refund for HGB Prime Transaction?

Example:

Subject: Dispute Request for Unauthorized Charge

Body: Dear [Bank Name] Support Team, I recently noticed an unauthorized charge labeled “HGB Prime” on my debit card. The charge of [$XX.XX] appeared on [date]. I did not authorize this transaction and request an immediate investigation and refund. Please let me know the next steps. Thank you.

How to Prevent Unwanted Charges in the Future?

To avoid unexpected charges like HGB Prime in the future, follow these best practices:

Maintain a List of Subscriptions

Maintain a list of all your active subscriptions and review them regularly.

Use Virtual Cards

Some banks offer virtual debit card numbers for online purchases, which can help protect your primary card. I prefer this card because I mostly use virtual cards for my online purchases.

Enable Transaction Alerts

Set up notifications for every transaction on your debit card to catch unauthorized charges early.

Read the Terms and Conditions

Before signing up for a service, review the terms to understand billing practices and cancellation policies.

Protect the Card Details

To protect the card details such as enable two-factor authentication, and avoid using public Wi-Fi for financial transactions. Most important block the auto renewals of the subscriptions.

Read More What is CCI Care.com Charge on Bank Statement? A Simple Guide

FAQs – Frequently Asked Questions

Final Thoughts

The HGB Prime Charge on your debit card might be confusing sometimes, but with the right steps as stated above, everyone can easily identify the source and take action if needed. Whether it is a legitimate or unauthorized transaction, staying informed and proactive is key to protecting your finances.

If you found this guide helpful, share it with others who might benefit from it. And remember, always keep a close eye on your bank statements to stay in control of your financial health!